Feed In Tariff: A Simple Mechanism to Promote Adoption of Renewable Energy

Introduction

Feed in tariff (FIT) is an incentive-based mechanism which aims to encourage renewable energy investments. It works in the context of a private enterprise or an individual with a captive power plant installed on their own site.

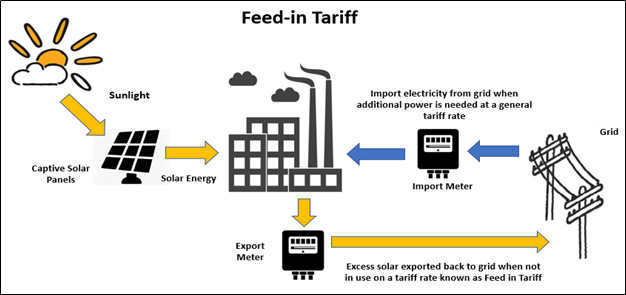

When the captive power plant generates more electricity than is required, the surplus can be supplied to the grid. This supply from the captive plant to the grid flows in the opposite direction to the conventional supply of electricity from the grid to the user. Both such flows of electricity (from grid to user and from user to grid) are monitored through special electricity meters.

FIT is a price-based support instrument like net metering (explained in figures 1 and 2) in which an owner of the captive power plant is paid a certain price per unit of electricity produced and supplied into the grid, by the distribution companies.

The payment of tariff is fixed for a defined period (10 to 15 years) by the electricity distribution companies based on the period of engagement and the cost incurred in the production of the energy. The tariff is pre-determined which could be increased annually to compensate for the inflation of operation and the increase in maintenance cost aligning with the market situation.

All the terms and conditions between the supplier and the buyer of electricity are listed under the Power Purchase Agreement (PPA). The technologies for electricity generation covered by FIT mechanism mainly include solar photovoltaics (PV), but could include other technologies like wind turbines, or biomass. Feed in Tariff is applicable for a variety of captive power plant owners such as homeowners, industries or farmers who can produce renewable energy.

FIT vs other incentive-based mechanism

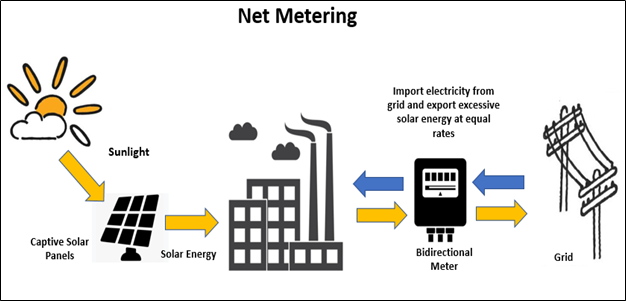

FIT is often confused with the net metering mechanism which is also an incentive-based mechanism that pays the owner for the electricity supplied to the grid. Although they are similar, the difference is that in case of net metering the tariff rate is the actual retail electricity rate present at that time, while in case of FIT this rate is fixed, predetermined and decided based on different conditions. According to Kris Walker of AZO Cleantech “Feed-in tariff for a producer is more cost-effective than most of the other policies that encourage renewable energy production”.

In net metering schemes, the meter starts turning ‘backwards’ once excess electricity is fed into the grid. The electricity price in case of net metering is not fixed and not guaranteed over a long period of time. Therefore, a net metering mechanism lacks price security and guarantee of a feed-in tariff and offers a lower degree of investment security.

Renewable energy auction is another type of support mechanism that is used by the national and state governments, wherein:

- They specify the required capacity of generation along with the technology.

- Project developers than submits their bids in the auction, with a project proposal and stating the price per unit of electricity at which they will be able to implement their power producingunit.

- The government then selects the bidder based on the cost and other criteria.

- A power purchasing agreement is then finally signed with the successful bidders.

The main difference between FIT and auctions is the price discovery mechanism. “For FIT the price is fixed by the policy makers, however, in auctions the industry determines the price for the project through competitive bidding between the bidders.” (Jacobs, 2015)

Advantages and limitations

The attributes of FIT are that it provides reliability, transparency and security for investors, and thereby has the potential to uplift the renewable energy market.

The advantages like long term contracts and guaranteed pricing provides shelter to the investors against some of the associated risks and ensure a reasonable rate of return. But the main challenge is to find out the optimal tariff which can benefit the producer as well as the distribution companies. In order to do so, the electricity regulatory bodies need to analyse the costs for renewable power generation based on many cost components, including investment, grid-related and administrative costs, operation and maintenance costs and fuel costs. The accuracy in estimation of these cost will always be an issue as it depends on various dynamic factors.

Another challenge associated with FIT as an incentive-based mechanism is that in some cases the distribution companies that are not profitable may not be able to operate at fixed tariffs. In such cases net metering with its variable tariff mechanism may be a better option.

International & Indian Context

FIT was implemented in the United States of America by the Carter administration in 1978 in response to the energy crisis of the 1970s. Since then FIT has been widely used internationally, mostly in Germany, Spain, and other parts of Europe.

Experience in Germany shows that the feed-in tariff was instrumental in increasing the power generated by renewable energy resources from 6.3% of total generation in 2000 to more than 15% in 2008 — an increase of more than 200% in eight years (Renewable energy world Issue 4 & Volume 12). Since then many countries have moved from FIT to the competitive auction-tendering paradigm. An increasing number of countries are employing reverse auctions to encourage competition and drive down solar tariffs. The experience showed that in many countries, the FIT mechanism played a vital role in promoting new sources of energy and once these got established, they gradually moved towards other mechanisms.

Similarly, in India FIT was introduced at the initial stages when renewable energy was introduced in the Indian market. It was used to promote wind energy projects and as the sector developed, the government moved towards reverse auction. Whereas in case of solar power, the procurement of projects primarily began through a reverse auction process since the inception of the National Solar Mission. According to Mercom India “The only time a large quantity of solar projects was procured through the FIT process in the country was when Gujarat in 2010 announced the procurement of 968 MW of solar PV at a feed-in tariff rate of ₹15/kWh for the first 15 years and ₹5/kWh for the next 15 years. Back then this was the most lucrative tariff in India and eventually, the cost of procurement was so high that the distribution companies had to cut the tariff rate it was paying to projects, citing excessive profits from project owners”.

Ever since the Gujarat experiment, no government agencies have actively used the FIT mechanism. But recently Indian government has notified state government to use FIT mechanism to promote solar water pumping under KUSUM (Kisan Urja Suraksha evem Utthan Mahabhiyan) Scheme. Based on the guidelines issued by the government at the end of 2019, the prefixed levelized tariff will be decided by the state governments for a period of 25 years.

Conclusions

A major challenge for the renewable energy sector is to make the clean energy costs compete with that of conventional energy.

FIT has proven to be remarkably adaptable and effective in promoting popularity of renewables in both developed and developing countries in its early stages. It can help to ‘democratise’ energy markets by allowing many actors to participate in the power generation business, including small and medium size companies, farmers and private persons.

While the policy structure is simple, finding the best FIT pricing level is still difficult. Also, based on the past international and national experiences, it is clear that FIT has been used as a promotional tool at the initial stages and later replaced by other incentive-based mechanisms. FIT can be used for promoting new technologies in future related to renewable energy like solar water pumps, floating solar, energy from biomass, energy from waste.

On the policy level even, the government can use FIT to uplift certain sections of industries or to promote an upcoming technology in the market. Inclusion of FIT by Indian government in the KUSUM scheme after such a long gap is a good example of it. It remains to be seen, how frequently will the government use FIT to promote upcoming technologies as well as policies in the future.

References

https://energypedia.info/wiki/Feed-in_Tariffs_(FIT)

https://www.eia.gov/todayinenergy/detail.php?id=11471

https://www.renewableenergyworld.com/2009/09/17/feed-in-tariffs-go-global-policy-in-practice/#gref

https://www.azocleantech.com/article.aspx?ArticleID=357

http://www.renewableenergyfocus.com/view/13313/introduction-to-feed-in-tariffs/

https://vikaspedia.in/energy/policy-support/renewable-energy-1/solar-energy/pm-kusum-scheme

Hashir has worked on resource efficiency assessment and solutions in Iron & Steel, Automotive and Water Supply industries in India.